Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Jun, 2023

Highlights

Despite the economic slowdown, 451 Research’s CPaaS Market Monitor projects ongoing demand and double-digit growth rates for this segment

We project the overall global CPaaS market will grow at a CAGR of 14% over the next five years, surpassing $28 billion by 2027

Introduction

Like many technology segments, communications platform as a service (CPaaS) — comprising vendors that provide developers with embeddable communications capabilities for their applications — faces numerous challenges including labor shortages, rising interest rates and inflation. However, our recent 451 Research CPaaS Market Monitor data shows strong potential for continued growth and a significant opportunity for telcos in particular, with the CPaaS enablement segment that primarily services them outperforming the overall market. While already divergent, the growth trajectory for CPaaS and CPaaS-enablement vendors has the potential to widen further. As telcos and communications service providers (CSPs) reposition to deliver digital business-to-consumer (B2C) services, their growing reliance on CPaaS platforms could have a profound impact, uplifting overall CPaaS market growth.

Despite the economic slowdown, our CPaaS Market Monitor projects ongoing demand and double-digit growth rates for this segment. Several factors should offset the impact of a rolling recession — namely, accelerated growth in regions outside of North America and pent-up demand from SMBs. These factors signal an important opportunity for telcos, particularly in mobile-first regions such as Asia-Pacific, Africa, the Middle East and Latin America. Although still in early stages, CPaaS-enablement vendors report growing pipelines with telcos looking to deliver API-based communication services. This could result in a compound annual growth rate for CPaaS enablement of 30% over the next five years and, subsequently, an uplift for the total CPaaS and CPaaS-enablement market with an overall CAGR of nearly 18%. This should have a compounded effect for the entire CPaaS ecosystem, with telcos, which currently hold a small market share, significantly expanding the overall CPaaS market opportunity.

Scenario analysis highlights bifurcation in the CPaaS market

Our scenario analysis entails an examination of the market opportunities facing two distinct types of CPaaS vendors: stand-alone CPaaS, primarily targeting developers and enterprise organizations, and CPaaS enablement, comprising CPaaS vendors focused on helping telcos and CSPs deliver API-based communication services.

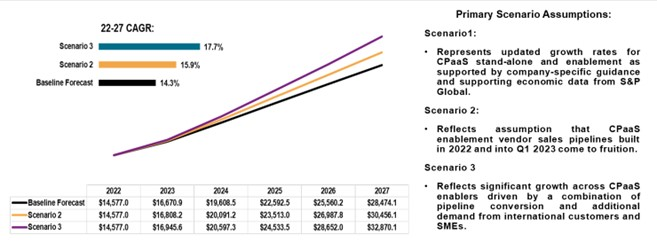

As shown in Figure 1, our Market Monitor projects the overall global CPaaS market will grow at a CAGR of 14% over the next five years, surpassing $28 billion by 2027. This is a downward adjustment from previous updates, reflecting the impact of macroeconomic factors that are likely to influence demand over the next five years, coupled with a slowdown in North America. Our updated forecast considers three potential scenarios and the impact that a higher growth rate for CPaaS enablement could have for the overall market.

Figure 1: CPaaS global revenue forecast ($M) and CAGR scenario analysis

Source: 451 Research's CPaaS Market Monitor (March 2023) © 2023 S&P Global.

Key forecast assumptions

Below, we outline some of the key assumptions in our scenario analysis.

The economic slowdown will result in an overall contraction in demand. 451 Research's Macroeconomic Outlook: SME Tech Trends, Organizational Dynamics survey looks at how organizations are planning to spend on IT products and services in the second quarter. As noted in a recent report, survey results show that overall spending sentiment on IT devices and services will remain poor through Q2 2023, with more respondents planning to reduce or stop spending than those planning to increase.

COVID-19 accelerated SMB digital transformation adoption. Although trailing large organizations, our research shows the number of SMBs launching digital transformation initiatives increased twofold in the two years following the COVID-19 outbreak compared with a similar period preceding the pandemic, signaling an important growth opportunity for digital-transformation-enabling technologies such as CPaaS.

Customer experience and automation are top priorities for SMBs. Our Macroeconomic Outlook survey shows the top IT-related priorities over the next 12 months for SMBs include improving the customer experience (38%), risk management (38%), and automating repeatable, day-to-day tasks (33%). Notably, these results reflect a quarter-over-quarter increase of nine percentage points in the proportion of survey respondents focusing on improving the customer experience.

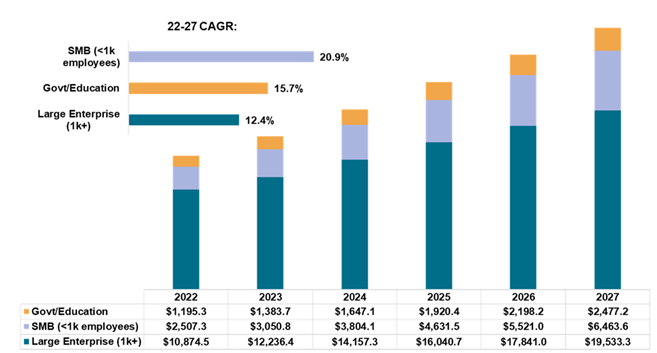

SMB pent-up demand for digital transformation represents a key growth opportunity. As shown in Figure 2, while the bulk of CPaaS revenue is generated from larger enterprises, SMBs represent a fast-growing segment. Our analysis projects the SMB segment will grow at a CAGR of over 20%, reaching just under $6.5 billion by 2027. This is a highly fragmented marketplace — given their extensive mobile footprints and existing customer relationships, telcos are uniquely positioned to address SMB requirements for customer experience improvement and task automation with API-based communication services.

Figure 2: Baseline global CPaaS market revenue forecast ($M) and CAGR by company size

Source: 451 Research's CPaaS Market Monitor (March 2023) © 2023 S&P Global.

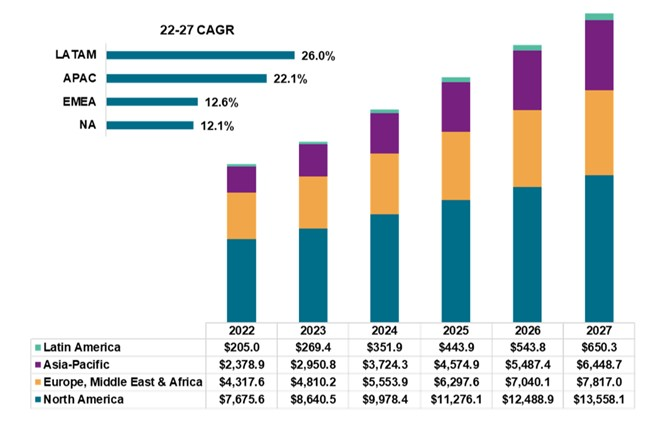

International expansion remains a key area of opportunity. While revenue for the top-tier vendors is currently concentrated in North America, our estimates point to a shift toward regions outside of North America representing most of the market revenue by 2025. This is a delay from prior forecasts of an international takeover by 2024 — primarily due to the uncertain economic environment in EMEA and adoption in mobile-first regions such as Asia-Pacific and the Middle East taking off in 2023-24 (Figure 3).

Figure 3: Baseline global CPaaS market revenue forecast ($M) and CAGR by region

Source: 451 Research's CPaaS Market Monitor (March 2023) © 2023 S&P Global.

Research

Research